Table Of Content

During the Great Depression, one-fourth of homeowners lost their homes. You can think about refinancing (if you already have a loan) or shop around for other loan offers to make sure you’re getting the lowest interest rate possible. Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay — $514,715 in total. Each month we’ll pay $2,859.53, over 60% more than with the 30-year loan. When all’s said and done, for a 30-year loan at 3.5% interest, we’ll pay $1,796.18 each month.

Keep your debt-to-income ratio low

Make sure to ask your lender how long your pre-approval lasts, or look for this expiration date on your pre-approval letter. For an instant estimate of what you can afford to pay for a house, you can plug your income, down payment, home location, and other information into a home affordability calculator. The calculator also allows you to easily change certain variables, like where you want to live and what type of loan you get. Plug in different numbers and scenarios, and you can see how your decisions can affect what you’ll pay for a home.

How to Use the 30-year Mortgage Calculator

To remedy this situation, the government created the Federal Housing Administration (FHA) and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards. When a loan exceeds a certain amount (the conforming loan limit), it's not insured by the Federal government. Jumbo loans allow you to purchase more expensive properties but often require 20% down, which can cost more than $100,000 at closing.

House affordability calculator - CNN

House affordability calculator.

Posted: Mon, 13 Sep 2021 19:00:05 GMT [source]

Affordability calculator

Corporate bonds, physical gold, and many other investments are options that mortgage holders might consider instead of extra payments. You can calculate the daily interest on your loan by multiplying your remaining principal balance by your mortgage rate, then dividing by 365. If you’re paying off your loan on the 15th of the month, your payoff amount would be 15 multiplied by your daily interest amount plus your remaining principal balance. Keep in mind, however, that just because you can afford a house on paper doesn’t mean your budget can actually handle the payments. Beyond the factors your bank considers when pre-approving you for a mortgage amount, consider how much money you’ll have on-hand after you make the down payment. It’s best to have at least three months of payments in savings in case you experience financial hardship.

What Is a Reverse Mortgage?

As a general rule, to qualify for a mortgage, your DTI ratio should not exceed 36% of your gross monthly income. The longer the term of your loan — say 30 years instead of 15 — the lower your monthly payment but the more interest you’ll pay. The United States Department of Agriculture backs USDA loans that benefit low-income borrowers purchasing in eligible, rural areas. While an upfront funding fee is required on these loans, your down payment can be as little as zero down without paying PMI. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Mortgage payment formula

The payoff statement is good for a certain period of time, say 30 days, which will be specified in the statement. It just means you’ll have to repeat the process when you are ready. Also, expect your lender to send a canceled promissory note—an agreement you signed when you filled out your mortgage application and established your loan obligation. You may have to pay a prepayment penalty if you pay off your mortgage within the first few years of the life of the loan. That amount can be hefty—often as much as 2% of the mortgage amount—enough to impact your calculations about early payoffs.

Lock in Today's Mortgage Rates Right Now!

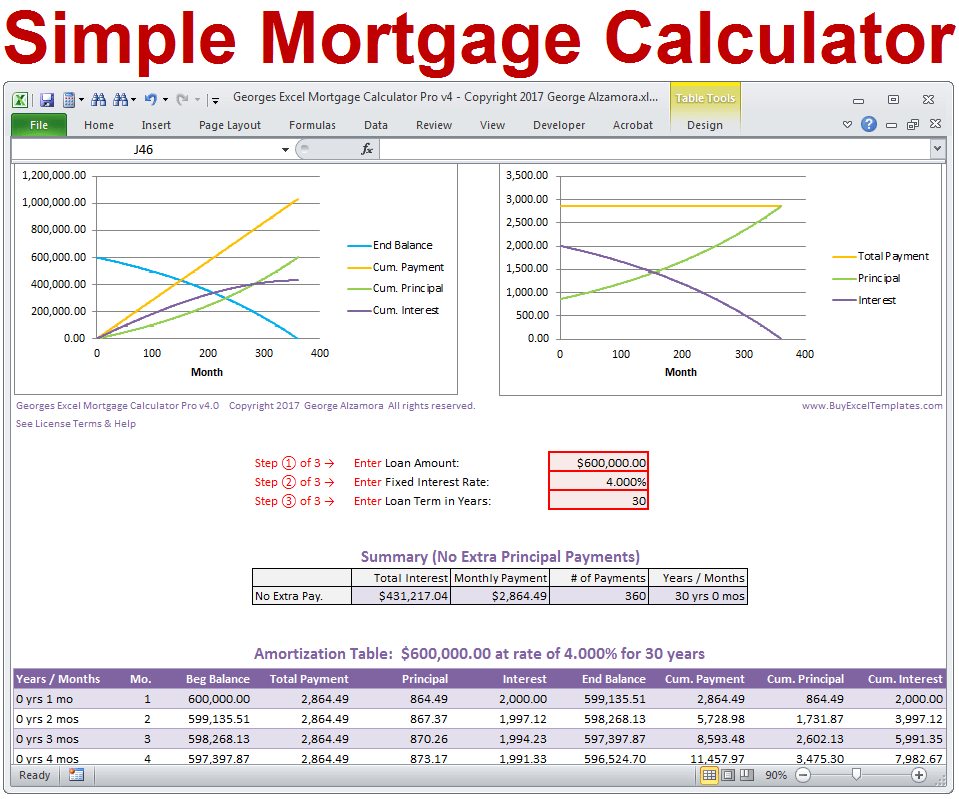

Our mortgage calculator can help you estimate your monthly mortgage payment. This calculator estimates how much you’ll pay for principal and interest. You can also opt to includes your taxes and insurance in this payment estimate.

Note that mortgage insurance on FHA loans is applied differently and can be more difficult to get rid of without refinancing. Coming up with a down payment can be the hardest part of buying a home—particularly for first-time buyers. Though it makes financial sense to go with a down payment of at least 20%, it’s not always possible to save that much once you realize you’re ready to buy a house and need a place to live. The average American home loan will cost anywhere from $2,162.46 to $3,482.12 per month, depending on the term of your mortgage and the down payment you make.

Fidelity Smart Money℠

If you don’t consider them all, you may budget for one payment, only to find out that it’s much larger than you expected. A mortgage loan term is the maximum length of time you have to repay the loan. Longer terms usually have higher rates but lower monthly payments. It is possible to pay down your loan faster than the set term by making additional monthly payments toward your principal loan balance. A mortgage is a secured loan that is collateralized by the home it is financing.

You can also adjust the interest rates to see your payments based on market conditions or your credit score. You can expect to pay the lowest interest rate available if you have excellent credit. If you don’t have stellar credit, you can still qualify for a mortgage, but it might not be at the lowest rate. Say you have a hybrid-ARM loan balance of $100,000, and there are 10 years left on the loan.

Your mortgage lender should be able to give you an estimate based on where you're planning to buy. Your debt-to-income ratio (DTI) refers to the percentage of your monthly income that goes toward paying off debt. Since lenders look at DTI to make lending decisions, having a high DTI can keep you from qualifying for other loans in the future. Mortgage payments are amortized, which means the size of the payment (on a fixed interest-rate loan) stays the same throughout the repayment period. The amount going toward interest gradually decreases while the amount going toward principal gradually increases.